Perhaps the most lasting impression of the Great Recession is that it made $1 trillion seem small.

It seemed like a financial apocalypse, as the U.S. stock market lost half of its value and markets around the world suffered from similar routs.

The Great Recession wasn’t so great, though, as a recovery began soon after. Yet it is having a ripple effect today, even after a decade has passed. Looking back at the past year, it’s the end of December that stands out, as the stock market took a beating. It was the worst year for stocks since 2008.

The Dow Jones Industrial Average (DJIA) finished the year down 5.63% and the S&P 500 Index had an even worse year, finishing down 6.24%. The Nasdaq Composite Index finished 2018 down 3.88%, but the Russell 2000 fared worse of all with a 12.18% drop.

Economy Boomed, Stocks Didn’t

The year 2018 was a year of opposites. The economy performed better than it had since before the Great Recession, yet the return of 3% growth was a stark contrast to the drubbing the stock market took as the year ended.

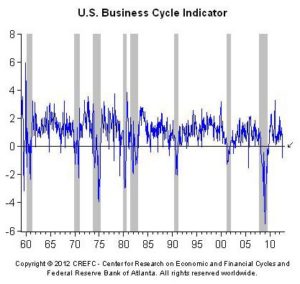

Conversely, after the Great Recession, the stock market boomed even as the economy fizzled. In our last blog post, we noted that automated trading is having a negative impact on fundamental analysis. The same could be said about the Fed’s monetary policy, as the market boomed after the recession, even though the economy was weak.

Much of the blame, of course, goes to the Federal Reserve Board. Just as the Fed’s zero interest rate policy (ZIRP) goosed the market upward for eight years, its policy of normalizing interest rates is now contributing to the market’s downward trend.

There are plenty of reasons for the recent wild swings — automated trading, decelerating growth of corporate profits, trade tensions and the government shutdown among them — but rising interest rates are also a factor. Rising interest rates are also causing a slowdown in the housing market, as rising rates make housing more expensive.

Blame the Pundits, Too

Until now, the Fed has been able to raise rates without a significant impact on stock prices, because the economy was improving and the rate increases were small and gradual. The Fed raised the federal-funds rate eight times in the past three years without spooking investors.

Before the most recent rate increase, which took place in December, there was broad conjecture in the media by various pundits – and even Fed members – suggesting it was time for a pause before increasing rates again.

Because many were not expecting a rate increase, the Fed’s decision to increase rates likely had a greater impact on markets than it might have otherwise had.

Fed officials are now projecting two rate hikes in 2019, instead of three as initially planned. We’ll be watching with great interest.