“Can a robot write a symphony? Can a robot turn a … canvas into a beautiful masterpiece?” From I, Robot

It turns out there’s not much that can’t be automated. Self-driving cars are in our not-too-distant future. IBM’s Watson computer beat the best human contestants on “Jeopardy.” Drones will soon be delivering packages to your home. And super-fast computers are running our stock market.

As The Wall Street Journal reported, “Roughly 85% of all trading is on autopilot — controlled by machines, models, or passive investing formulas, creating an unprecedented trading herd that moves in unison and is blazingly fast.”

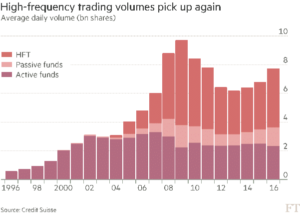

We’ve previously written about high-frequently trading, which games the system against the average investor by taking advantage of tiny pricing inefficiencies, but there are plenty of other examples of automated trading. Add in quantitative hedge funds, passive funds and index funds, as well as trading by market makers.

And robo-trading is likely to play an even greater role in the future. As The Financial Times noted, “markets are increasingly going to be shaped by machines rather than man.”

Disturbing Consequences

Given that computers can identify inefficiencies and make trades in nanoseconds, it’s a wonder that anyone made of flesh and blood is even trading anymore. Yet consider the consequences that automation is having.

Wild price swings. Like a self-driving car propelling its passengers over a cliff, automation is driving the stock market along a road we’d rather not be on.

The Wall Street Journal attributes recent wild swings in stock prices to automation.

The only logic machines have is the logic that’s built into them. An algorithm, a set of instructions programmed to carry out a specific task, can’t take every situation into account, so sometimes there are unexpected — and undesired — consequences.

And, like “herd behavior on steroids,” as The Washington Post noted, when an algorithm acts on a perceived inefficiency, other computers follow suit. The result is a high volume of trading during a short time, causing significant swings in pricing.

Automated trading is based on “complex algorithms that focus on changes in market prices or indexes caused by the trading done by other computers,” according to The Post. “In this kind of robots vs. robots trading with its circular logic, fundamentals are irrelevant, the volumes are enormous and the holding periods are often a matter of minutes, or even seconds. More often than not, a ‘trade’ is likely to be a combination of trades – buying this stock, shorting that exchange-traded fund while selling a call option on some derivative instrument. And almost all of it is done with borrowed money.”

So you have a broad network of computers making trades in nanoseconds that are leveraged with borrowed money. What could possibly go wrong?

Forgetting fundamentals. Equally disturbing is that fundamentals become irrelevant in automated trades. Traditionally, fundamental analysis has been the cornerstone of investing. Analysts evaluate a company’s stock based on its financials, including the company’s profits, revenue and ability to repay debts. They compare the company with its competitors and review factors such as growth and price-to-earnings ratio to determine whether the stock is a good investment.

Now, according to The Post, the market is “divorced from fundamentals.” Instead, the market is running on an unending supply of data.

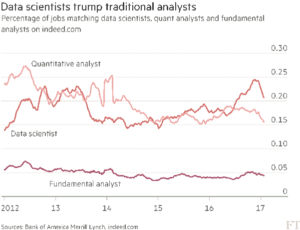

This shift from fundamental analysis is even affecting the job market. According to The Financial Times, “The growing view that the future of active investing will not be human fund managers judging a company by the firmness of the chief executive’s handshake but computer scientists tinkering with trading algorithms has led to an explosion of job postings for financial engineers, while demand for more traditional analysts has stagnated.”

Keep in mind that these trends will continue to escalate as algorithmic trading becomes even more widespread.

Flash crashes. Algorithms are only as good as the data used to create them. Sometimes, programming flaws can result in a rogue algorithm causing a flash crash.

The Financial Times noted that high-frequency trading is supposed to increase liquidity, but, “The most actively traded stocks are becoming even more liquid, while smaller stocks are becoming more expensive to trade. Flash crashes are becoming more common, with algorithms making, cancelling and adjusting quotes at a fast pace.”

We previously wrote about the flash crash caused by Knight Capital Group. The high-frequency trader was responsible for 17.3% of trades on the New York Stock Exchange before a $460 million computer error led to the company being acquired. A flash crash in 2010 erased $862 billion of share value in 20 minutes.

Some will argue that automated trading increases order efficiency and is less costly. Some will say that automated trading takes the emotion out of decision making, so that the result is based solely on data.

But is removing emotion such a good thing? Picture HAL, the computer in “2001: A Space Odyssey” (“I’m sorry, Dave. I’m afraid I can’t do that.”). Removing human decision making can have disastrous consequences.

Automated trading is here to stay, but for the sake of the average investor, as well as for public companies depending on the stock market to accurate reflect their value, it needs to be reined in.