The Federal Reserve Board routinely gets it wrong. Given the political nature of its work, the differing opinions of its seven governors and, especially, the subjective economic beliefs that influence decisions, is it any wonder?

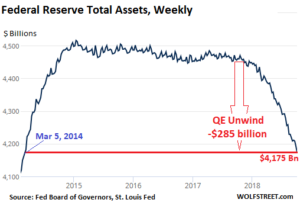

The challenge is especially acute now, given the extensive dovishness of the post-financial crisis board. Never before has the Fed kept interest rates near zero for more than seven years. Never before has the Fed purchased trillions of dollars’ worth of bonds. And never before has the Fed had to unwind the whole mess, raising interest rates back to “normal” levels, while selling off much of its $4.2 trillion portfolio of bonds.

With tax reform and deregulation fueling economic growth, the Fed has been able to inch its way toward “normalization” without shaking the confidence of consumers and business owners. The Fed raised the federal-funds rate eight times in the past three years without spooking investors, or torpedoing the stock market and the economy. But October’s market drop – the biggest pullback in seven years – is a sign that the road to normalization will have its share of potholes.

An Inexact Science

The problem is, economics is an inexact science, which uses models that are imperfect. Economists often seem to be guessing. There is no “normal” level for interest rates, unemployment, the inflation rate, growth in gross domestic product (GDP) or the size of the Fed’s portfolio.

So how much longer should the Fed continue to raise rates and how high should they go?

If the Fed is too dovish and keeps interest rates too low for too long, inflation could spike. And if a recession hits, it will have little room to decrease rates as needed to stimulate business investment and consumer spending. Conversely, if it becomes too hawkish and raises rates rapidly, it will stunt economic growth and cause stock prices to drop.

Adjustments need to be made on an ongoing basis and their impact is not immediate, so if the Fed overshoots or undershoots, no one knows until it’s too late to avoid the damage.