So the Federal Reserve Board has made it official. This is the end of quantitative easing. It’s quits for QE. Bond buying has gone bye bye. Quantitative easing has been eased out of existence, tapered into extinction. The QE case is closed.

If nothing else, QE has provided us with material for more of our blog posts than any other topic (55, not including this one!), so, given that we’ll now need a new source of inspiration, we’re almost sorry to see it end.

So is this an obituary for the greatest (in terms of dollars involved, if not in results) experiment ever in monetary policy? Should we hoist up the “Mission Accomplished” banner, pop the champagne cork and make a toast to Ben Bernanke and his brethren?

Not so fast. There’s still an epilogue worth drafting. Closure is needed. This may be our last chance to take a shot at QE, so we’re taking advantage of it.

QE’s Economic Impact

An important question needs to be answered. Is the Fed done with QE because it’s succeeded or because it’s failed?

GDP Growth. As the latest sign of QE’s “success,” consider that the economy grew by 3.5% during the third quarter. We predicted that the growth number would be high, given that it was being released by the Bureau of Economic Analysis just days before the election. This is a preliminary number that will be revised ad nauseum before the BEA issues its final estimate … which will still be just an estimate.

But even if the number is accurate, it should be considered in the proper context. As we’ve pointed out repeatedly, gross domestic product (GDP) has grown at an average rate of 3.3% a year since the end of World War II. Even if growth in GDP is finally increasing, it rose by just 2.3% on a year-over-year, inflation-adjusted basis.

As Michael Feroli, chief U.S. economist at J.P. Morgan Chase, put it, “I don’t think there’s any question that compared to Europe or Japan we’re looking pretty good here. But relative to our own standards and history, we’re still in a disappointing expansion.”

It should also be noted that much of the boost in GDP is due to one-time measures. One irony behind the numbers is that the biggest growth factor was an increase in defense spending, which accounts for 0.66% of the 3.5% growth rate.

Maybe if the nearly $1 trillion in “stimulus spending” that was supposed to boost the economy in 2009 went into the defense budget instead of being used for entitlement spending, the economy would have been booming years ago. Imagine what a stimulus the economy will enjoy when we finally send in ground troops to fight the Islamic State!

We could go into detail about the fragile employment numbers and the still-shaky housing market, but we’ve already written plenty about those numbers.

Inflation. Another issue that deserves attention is the Fed’s goal of increasing inflation to 2%. Those of us in the real world, who have seen prices increase by far more than 2% for healthcare, food, gas, electricity and other necessities, might have suggested to the Fed that the economy could handle lower prices. Low inflation means more money for discretionary spending, which is supposedly the most important contributor to economic growth.

Ask yourself this question. Which has done more to help the economy – the Fed’s efforts to increase inflation or the recent lowering of oil prices, which has caused the price of gas to dip to $3 a gallon?

Unintended Consequences. Keep in mind that QE isn’t happening in a vacuum. The Fed’s accumulation of a portfolio that now exceeds $4.2 trillion will have consequences.

We’re not suggesting a post-QE financial apocalypse, but consider these comments on Zerohedge: “It wasn’t the stock market crash in 1929 that ‘created’ the Great Depression. It was a decade of loose money policies by the Fed that created a shaky economy. Again, if anything the stock market crash was the result of stock prices being too buoyant and in need of a repricing to reflect economic fundamentals. Just like today, stocks rose to such storied heights as a result of cheap credit, not because of the seemingly ‘great’ investments funded by it.

“Just as cheap credit of the 1920s beget the Great Depression, that of the 1990s beget the dot-com bust and that of the mid-2000s beget the crisis of 2008, this most recent period will also give birth to a financial crisis.”

Would the economy have been better off without QE? Will QE be a catalyst for another financial crisis? Time is needed to provide perspective.

QE Is Dead. Long Live QE.

As a final point, it’s worth noting that QE may deserve not only this epilogue, but additional chapters.

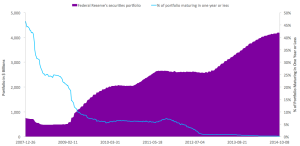

- The Fed now has $4.5 trillion in assets on its balance sheet. As The Wall Street Journal noted, “In that sense QE is not over, and the Fed will still reinvest the principal payments from its maturing securities. Economist David Malpass has warned on these pages that those assets will eventually tempt politicians to grab for a sovereign wealth fund.”

- The Fed has shifted its portfolio, so it now holds only bonds with long-term maturities (see chart). It no longer holds any bonds with maturities of less than a year. This shift may have helped prop up the stock market, but, as we’ve previously noted, it’s very risky.

- QE is alive and well in other parts of the world. Yesterday, the Bank of Japan announced that it would “monetize JPY80 trillion in JGBs, up from the JPY60-70 trillion currently and expand the universe of eligible for monetization securities.”

Meanwhile, speculation about the European Central Bank adopting QE has been boosting markets globally, even though if or when it will happen remains uncertain.

So QE is dead. Long live QE