If you repeat something often enough, you may even start to believe it.

So try this phrase: “The economy is improving. The economy is improving. The economy is improving.”

Certainly, the U.S. Bureau of Economic Propaganda (aka, the U.S. Bureau of Economic Analysis or BEA) would have you think that’s the case. The BEA initially reported growth in gross domestic product (GDP) of 4% for the second quarter of 2014. That seemed like quite a leap from the first quarter’s -2.9% contraction, but the BEA adjusted that number to “negative growth” of -2.1%.

That’s old news, though. Thanks to “a larger than previously estimated increase in nonresidential fixed investment,” the BEA announced in August that second quarter growth was really 4.2%. A swing of 6.3% in a single quarter! Well done!

But wait … there’s more. The BEA announced in September that second quarter growth was 4.6%! The BEA cited “growing personal consumption, private inventory investment, exports, both residential and nonresidential fixed investment, as well as local government spending,” none of which apparently existed when the BEA gave its first two estimates.

We can hardly wait for October 30, when the BEA is scheduled to report Q3 results. Maybe by then, we’ll learn that second quarter growth exceeded 5%. It will be interesting to find out whether Q1’s negative growth was an aberration or whether Q2’s giant leap forward was an aberration.

So do you think we’ll find out that the recovery is over? Or will we finally break past the wimpy 2% growth we’ve seen throughout the current recovery and see some real growth?

Q3 results will be reported just days before an important national election. Days before the Presidential election, you may recall, the unemployment rate finally fell below 7%. Maybe we’ll see another economic miracle for this election.

Questions About the Economy

So let’s assume that the numbers show growth for Q3, indicating that the recovery is continuing. We also now have an unemployment rate below 6%. Of course that’s the U-3 rate, but add it all up, and keep repeating the phrase, “The economy is improving,” and you may convince yourself that happy days are here again.

You could do that, but instead of cheering an unemployment rate that’s now under 6%, why not ask why it took so long to get there. While we’re at it, let’s find out why the jobs that are being created are primarily part-time, minimum wage jobs and why there aren’t more higher-paying jobs that matter.

Let’s ask why the Federal Reserve Board is trying so earnestly to raise the inflation rate to 2% and, if it succeeds, why that will be such a good thing for the economy. Higher inflation is a symptom of a healthier economy, but raising the inflation rate doesn’t necessarily make the economy healthier. If American incomes are 8% lower than they were in 2007, raising prices will further erode our quality of life.

Let’s ask what the Fed’s next policy is and why Wall Street is so scared of the potential for rising interest rates – even though higher rates would be a return to normalization. When will we find out what the Fed means by “macroprudential supervision?”

Let’s ask, too, why so little has been done to control the federal deficit, which has grown to more than $17.4 trillion, or to control the unfunded liabilities from Medicare, Social Security and government employee pensions, which exceed $100 trillion. What happens to the cost of servicing that debt when interest rates rise?

Let’s ask why Congress and the President have taken virtually no action to help the economy grow since before the financial crisis. True, we did spend nearly $1 trillion on “stimulus” legislation. Let’s ask for an audit and find out where that money went.

Let’s ask for tax reform. America still has the highest corporate tax rate in the developed world and, until recently, corporations were addressing the problem themselves through “inversions,” in which they merge with foreign companies, then move their headquarters abroad. When will action be taken to make the U.S. more competitive? When will tax subsidies for favored corporations stop?

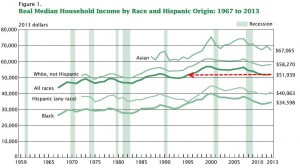

Let’s ask why the average American’s income has shrunk to 8% below what it was in 2007; according to the U.S. Census Bureau’s 2013 Income and Poverty Report, real median household income has declined to the level it was at in 1994. In 1994, hardly anyone was using the Internet.

Let’s find out why the workforce participation rate shows that more than 100 million Americans are still not working, regardless of what the unemployment rate is supposed to be.

Let’s ask why GDP has been below 2% for five years and why today, it’s suddenly leaped forward. Let’s ask how those numbers are calculated.

Let’s ask why Fed Chair Janet Yellen is now sounding off about “income inequality,” even though Fed policy has created the greatest income gap in history. Let’s ask, too, who put the Fed in charge of economic policy? The Fed’s mandate used to be controlling inflation through monetary policy. Now the Fed manipulates the markets (superbly) and runs the economy (poorly).

Let’s ask why, even with the lowest interest rates in history, the housing market has not recovered. And if the market is as lackluster as it is today, let’s ask what will happen to housing when interest rates increase.

Maybe the economy really is improving, but the recovery would be more credible if some of these questions were answered