So the taper begins in January. Big deal.

That was the market’s initial reaction anyway. In fact, the market viewed this week’s announcement as a positive, setting yet another record. Conversely, when Fed Chairman Ben Bernanke first brought up the possibility of a taper in May, he sent the market reeling. So talking about buying bonds has a greater impact than actually buying bonds. Who knew?

Some believe the stock market rallied because The Fed made it clear that it will remain accommodative and that interest rates will remain near zero until the apocalypse. That being the case, though, why did bond yields soar? Go figure.

The taper announcement is not a big deal, though, because everyone knew it was coming – everyone except for the economists whose job it is to tell us when tapering is coming. First they guessed wrong that it was coming in October, then they guessed wrong that it wasn’t coming in December. Keep that in mind when you hear them tell you the economic benefits of more bond buying and more government spending.

It’s also no big deal because it’s not much of a taper. The Federal Reserve Board will now purchase $75 billion in bonds each month instead of $85 billion. In other words, instead of printing money 24 hours a day, seven days a week, the presses will take off a few hours on Sundays and maybe Christmas.

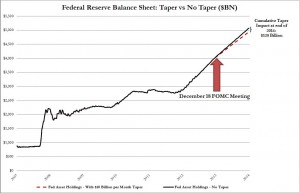

Fed Chairman Ben Bernanke says that tapering shouldn’t be confused with tightening and he has a point. If you tightened your belt the way The Fed just tightened monetary policy, your pants would still fall down. If the taper were a haircut, it would literally be a hair cut, as the chart shows.

The Fed’s portfolio is now $4 trillion and, projecting to the end of 2014 at the current rate of bond buying, it would grow to $5 trillion. At the tapered rate, it would grow to $4.9 trillion. Granted, if tapering continues, it will eventually have an impact, but the chart does provide some perspective.

Economic Recovery?

The taper, at best, is a paper tiger; it’s nothing for the quantitative-easing addicts on Wall Street to fear. While Lady in Waiting Janet Yellen voted for the taper, she’s a bigger QE booster than Helicopter Ben, so QE is not going away anytime soon. Most Fed members are on board as well; board members may not wear beads and bell bottoms, but, on the whole, they’re doves.

The paper taper is a bigger deal from a symbolic perspective, as it’s the first tentative step toward a rational monetary policy. It signals that the economy is finally recovering … although it really isn’t and, even if it were, it would be in spite of, not because of, quantitative easing.

Much has been made of the unemployment rate dipping to 7%, but has unemployment really dropped as advertised? The workforce participation rate remains stuck at about 63% and, although the unemployment rate is trending downward, the U-6 rate, which we refer to as the real unemployment rate, is still 13.2%.

Keep in mind, too, that during the bad-old days, of the George W. Bush presidency, the U-3 rate was as low as 4.4%. And even with lower unemployment, economic growth remains in the 2% range and the economy is closer to a whimper than a boom.

QE enthusiasts take heart. If this one-month drop in unemployment fails to take hold long-term, there’s always the possibility of even more quantitative easing ahead. Why stop at $85 billion a month?

QE could also untaper because of the Fed’s ongoing paranoia about deflation, which never seems to appear. The fear of deflation is grounded in the lack of excessive inflation, which also never seems to appear, in spite of all of the bond buying.

As Zerohedge put it, “the Fed does not give much credit to the (Bureau of Labor Statistics’) definition of inflation, because while the Fed has now repeatedly observed that the unemployment rate is sliding due to the collapse in the participation rate and hence labor improvements are simply a mathematical mirage, its core lament was the very subpar, and outright disinflationary CPI readings. Readings, however, which if taken seriously, would not have allowed the Fed to taper right here and right now.”

And, economic cycles being what they are, the current nirvana of nearly 2% growth per year can’t continue forever and another recession may be forthcoming – with a major assist from ObamaCare. A recession or even slower growth could also cause gnirepat, or tapering in reverse.

Zerohedge also noted that, “the faster the economy relapses into a sub-2% growth rate (and Obamacare will promptly help out in that department in the new year), the faster the Fed will take a long, hard look at returning to its baseline $85 billion (or more) per month liquidity injection.”

So don’t fret, QE junkies. Just because tapering is about to begin doesn’t mean that quantitative easing is about to end. It’s far from done.