With the Federal Reserve Board celebrating its 100th birthday, it’s a good time to look back on the past century to see how The Fed has fared.

We’ve been critical of The Fed’s quantitative easing program, but that accounts for only the past five years of Fed history. How has it fared in the previous 95 years? Overall, has its work improved life for Americans or has it been a negative force?

The Fed’s role is to ensure the safety and soundness of financial institutions, stability of financial markets, and equitable treatment of consumers in financial transactions. But its activities are primarily focused on using America’s money supply to manage inflation, unemployment and interest rates.

If The Fed has performed its job well, America’s standard of living should be greatly improved today when compared with, say, 1938, when the country was still recovering from The Great Depression.

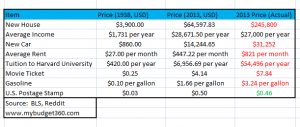

But MyBudget360 made some surprising discoveries when it compared 1938 prices with today’s prices after using the U.S. Bureau of Labor Statistics inflation calculator to adjust for inflation.

Consider, for example, that the average price of a house would be $64,597.83, a new car would cost $14,244.65 and gas would cost $1.66 per gallon if 1938 prices were adjusted for inflation. Instead, the average house costs $245,800, which is 3.8 times higher; a new car costs an average of $31,252, which is 2.19 times higher, and gas costs nearly twice as much as the inflation-adjusted price from 1938.

Of course, our overall quality of life has improved significantly since 1938. Today’s cars have safety features, GPS, heated seats and other technological advances that didn’t exist in 1938. Houses are larger, there have been tremendous improvements in healthcare and the average life expectancy has continuously moved up since then.

And the cost differential is not all The Fed’s fault. While gas prices have been affected by inflation, federal taxes on gas have increased and other political and economic factors have also had an impact.

Surprisingly, a postage stamp for mailing a first-class letter costs slightly less today than it would when adjusting for inflation, but postage costs are scheduled to increase next year to 49 cents, a penny short of the 1938 cost adjusted for inflation.

But what else accounts for the huge differences between what we pay and what we would be paying, based on 1938 dollars?

The big difference, according to Zerohedge, is today’s heavy use of credit. In 1938, consumers didn’t have credit cards and most families were supported with one income. Prices adjusted based on what consumers could afford.

The price of college tuition, likewise, has continuously risen at well above the rate of inflation as the federal government has made an increasing amount of money available for college loans.

According to Zerohedge, “The Fed has created a system where debt is now equal to money.” Keep that in mind the next time you hear outgoing Fed Chair Ben Bernanke or the presumed next Fed Chair Janet Yellen say that the rate of inflation is too low.

Iatrogenics: Impact vs. Intent

The term iatrogenics initially referred to actions by doctors that that hurt patients, but it describes government actions that have the opposite of their intended or stated consequences.

The Fed’s policies seemed guided by iatrogenics, but there are many other examples:

- As stated above, the federal government’s lending program for higher education has enabled colleges to raise their tuition to ever-higher levels.

- The Affordable Care Act, which was supposed to decrease the number of uninsured Americans has increased the number by millions, while making health insurance more unaffordable than ever.

- Extended unemployment benefits contribute to the high rate of unemployment, as people don’t look for new jobs as diligently when their benefits are extended.

- A provision in the Dodd-Frank Act that creates liability for lenders if they approve mortgages for consumers who later say they cannot afford to make their monthly payments has resulted in making it more difficult for consumers to qualify for a mortgage.

- Increasing the minimum wage reduces the number of minimum-wage jobs that are available.

- In his book Coming Apart, Charles Murray explains how $15 trillion in welfare spending over the past 50 years has resulted in a poverty rate of 15.1 percent, which is a 50-year high.

We noticed this phenomenon of government programs often having the opposite of their intended effect. At least now we have a name for it.