A taperphobia epidemic has Wall Street in a panic yet again. “Taperphobia” is an irrational fear of common sense. Symptoms include a falling stock market, soaring bond yields and ongoing anxiety attacks. There is a cure, but it’s expensive – it costs at least $85 billion a month, but that’s enough to cure all of Wall Street and send the stock market soaring.

Taperphobia was discovered by Federal Reserve Chairman Ben Bernanke in May, when he invented a new definition for the word “taper,” using it to describe the gradual slowdown of quantitative easing (another phrase he invented, which translates to “buying bonds forever”).

Symptoms of taperphobia subsided through calm reassurances of ongoing bond buying to eternity, but they returned in October, because most economists had predicted with absolute certainty that tapering would begin then.

It didn’t, so taperphobia subsided again. But now, thanks to discussions by board members included in minutes of the Federal Reserve Board, many believe that tapering will begin soon.

Remain calm, though. Remember that the Bernanke era ends in January. When he is replaced by Janet Yellen, there will be plenty of support for more quantitative easing. You may experience great anxiety, falling stock prices and rising bond yields until then, but remember that help is on the way.

Bad News to Cheer You Up

Then again, you may not need the QE Queen for help.

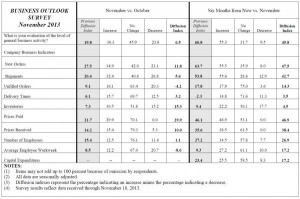

The Philadelphia Fed reported this week that the current employment index fell 14 points this month from its October reading to 1.1. While nearly 13% of companies surveyed reported increases in employment, that’s significantly lower than last month, when 23% reported increased employment. In addition, the number of employees slid from 15.4 to 1.1 and the average employee workweek dropped from 8.5 to -8.6.

Several leading indicators also plummeted. New orders dropped, from 27.5 to 11.9; shipments, from 20.4 to 5.6, and unfilled orders, from 9.1 to -4.2.

The report noted that, “Labor market indicators showed little improvement this month.” No kidding.

But, of course, bad news for the economy is good news for QE addicts. The cure for taperphobia may have been found.