The economy recently has been full of stops and starts, ups and downs, good news and bad news.

Optimists will say that progress is being made, as we’ve moved beyond the all-bad-news days of 2007 and 2008. Those of us who are less than optimistic would instead ask why it’s taken five years to get to the current dismal economic state.

Recovery always seems to be just around the next corner. But the world is round and there is no next corner.

Zerohedge recently ran a series of 13 charts showing that any economic exuberance is irrational. The charts compare the current “recovery” with four previous recoveries. The trend lines in most cases are almost identical – except that the lines representing the current Keynesian-inspired recovery are well below the lines representing the previous four recoveries. They show that:

- Growth in gross domestic product is pitifully low. If it were a patient, GDP would be signing up for hospice care.

- The ISM Manufacturing Index has fallen significantly from two years ago.

- Business inventories have risen significantly, signaling that new orders will likely drop.

- Productivity is down, consumer spending is lackluster and housing starts, though improving, are nowhere near what they should be if the housing market were really recovering.

But cheer up … vehicle sales are up! The recovery must be just around the next corner, wherever that is.

Unemployment Drops … Sort Of

You can add to all the not-so-good news the announcement this week that the unemployment rate has dropped from 7.6% to 7.4%.

Of course, that’s the unrealistic, but widely quoted U-3 rate, which goes down every time someone stops looking for work or becomes desperate enough to take a job running the deep fryer at McDonald’s.

While the jobless rate is inching closer toward that magic 6.5% number at which the Federal Reserve Board said it would stop its quantitative easing (QE) program, job growth is slowing.

Government analysts revised and lowered their job growth numbers for May to 176,000 and for June to 188,000, but July produced just 162,000 net new jobs, marking the most stunted increase in four months.

Since the start of the year, about half of all jobs created have been in retail, temporary help and the hotel-restaurant-leisure industries. Think Obamacare has anything to do with that?

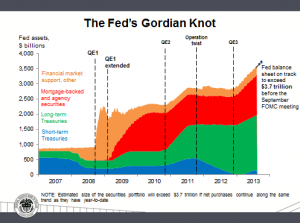

The Gordian Knot

Also lurking just around the corner is the necessary dialing down of quantitative easing. When that will happen is anyone’s guess, but the Dallas Fed’s Dick Fisher makes a compelling case for tapering to begin imminently. Here is, in part, what he said:

“Whereas before, our portfolio consisted primarily of instantly tradable short-term Treasury paper, now we hold almost none; our portfolio consists primarily of longer-term Treasuries and MBS (mortgage-backed securities). … (W)e now hold roughly 20 percent of the stock and continue to buy more than 25 percent of the gross issuance of Treasury notes and bonds. Further, we hold more than 25 percent of MBS outstanding and continue to take down more than 30 percent of gross new MBS issuance. Also, our current rate of MBS purchases far outpaces the net monthly supply of MBS.

“Whereas before, our portfolio consisted primarily of instantly tradable short-term Treasury paper, now we hold almost none; our portfolio consists primarily of longer-term Treasuries and MBS (mortgage-backed securities). … (W)e now hold roughly 20 percent of the stock and continue to buy more than 25 percent of the gross issuance of Treasury notes and bonds. Further, we hold more than 25 percent of MBS outstanding and continue to take down more than 30 percent of gross new MBS issuance. Also, our current rate of MBS purchases far outpaces the net monthly supply of MBS.

“The point is: We own a significant slice of these critical markets. This is, indeed, something of a Gordian Knot. … (W)e need to stop building upon the knot. For this reason, I have advocated that we socialize the idea of the inevitability of our dialing back and eventually ending our (quantitative easing).”

In other words, the longer QE continues, the more twisted QE’s Gordian knot becomes and the more difficult it will be to untangle. We’re not sure, though, how the Fed can “socialize the idea of the inevitability” of dialing back.

QE has goosed the stock market to new highs, creating an illusion of prosperity. What happens when that illusion disappears? We may soon find out.