Gold prices are no longer setting records. Special parties are no longer being held where people can sell their gold jewelry at spectacular prices. The Midas touch for gold has faded.

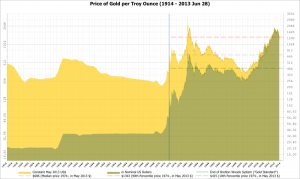

Gold was selling for as little as $256 an ounce in 2002 and soared to nearly $2,000 an ounce in 2011. An investment of $1,000 in 2002 would have been worth about $7,800 in 2011. In May 2013, though, gold was back down to $1,343 an ounce.

The Federal Reserve Board’s quantitative easing program not only distorted the prices of stocks and bonds, it also sent gold prices soaring for several reasons:

Record-low interest rates. As an investment, gold earns no interest, so when interest rates rise, gold typically drops in value. Conversely, when interest rates fall, the price of gold typically increases, although there have been times when gold prices hit record highs while interest rates were rising.

Currency devaluation. The Fed’s easy money policy also weakened the dollar. When the dollar weakens, gold becomes more attractive, so demand causes its price to increase.

Hedging. Gold is often used as a hedge against inflation and sometimes as a hedge against deflation. While the inflation rate has remained low, increasing inflation has been a stated goal of The Fed.

Why Gold Is Still Relevant

If the economy strengthens and interest rates continue to rise, the price of gold could continue falling.

However, it’s not clear that the economy is strengthening. Unemployment remains high, Europe is still in turmoil and economic doldrums continue in much of the world.

In addition, if returns on bonds, stocks and other investments fail to adequately compensate for risk and inflation, demand for gold typically increases, causing its price to increase.

Rising interest rates are already resulting in a sell-off of bonds, and there are plenty of signs that stocks are overvalued. Recently, the S&P 500 was up 25% for the year, while corporate profits were up only 1% from a year ago, which shows that there is currently a disconnect between stock values and market performance.

And while inflation remains in check, it is likely to increase in the future. Inflation historically has risen rapidly in a short period of time. It could so do again, especially considering The Fed’s easy money policy and its desire to boost inflation.

There’s also uncertainty about the strength of the dollar. In fact, more than a dozen states are so concerned that Fed policy could cause the dollar to collapse, they’re pursuing policies that would allow gold bullion to be used as money.

“The legislation is about signaling discontent with monetary policy and about what Ben Bernanke is doing,” according to Loren Gatch, who teaches politics at the University of Central Oklahoma. “There is a fear that the government, or Bernanke in particular and the Federal Reserve, is pursuing a policy that will lead to the collapse of the dollar. That’s what is behind it.”

It’s unlikely that Americans will be using gold bars to buy their groceries anytime soon, but don’t be surprised if the price of gold rises again.