The current housing recovery is not a house of brick, but a house of cards.

The cards came tumbling down this week, as the U.S. Commerce Department reported that housing starts in June fell to their lowest level in almost a year. At June’s pace, new housing starts would total 836,000 for the year, down 9.9% from May’s 928,000 pace. Multi-family projects plunged 26.2%.

The announcement blunted the stock market rise initiated on Wednesday by Federal Reserve Chairman Ben Bernanke, whose warm-and-fuzzy comments (more fuzzy than warm) can be summarized as “we have no idea when quantitative easing will end and, even if we did, we wouldn’t say.”

In contrast to the Commerce Department’s data, builder confidence in the market for newly built, single-family homes rose six points to 57 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for July. It was the third consecutive monthly gain and the highest HMI reading since January 2006.

Where’s the Inventory?

Regardless, the drop in housing starts is troubling, considering that many claim that a lack of inventory is stalling a full-blown housing recovery.

However, that lack of inventory is one of two major factors that have been driving housing prices up.

Along with a lack of supply, there has been an increase in demand from institutional investors. In key markets, they have been buying up housing with cash, at asking price, which is distorting market conditions and causing prices to rise for everyone.

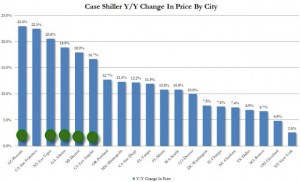

Note in the chart above that the cities where institutional investors have been buying homes by the tens of thousands are, not coincidentally, the cities that have seen the biggest price increases (the green dots mark the cities with the largest price increases).

Interestingly, Detroit saw the fifth largest increase in housing prices. If that were a sign of economic recovery, would Detroit have filed for bankruptcy this week?

Trouble Ahead

If the housing recovery is real and not a mirage, housing prices will continue to increase. However, several factors are likely to keep that from happening:

- Shadow Inventory. As we’ve previously pointed out, there’s a huge “shadow inventory” of homes that have not been available on the market. When lenders begin unloading those homes, prices may drop or, at the least, stop rising.

- Rising Interest Rates. While housing prices have been rising, so have interest rates. Rates for a 30-year conventional mortgage have risen from under 3.4% to over 4.4% since May, when Bernanke hinted that QE may not last forever. In spite of major backpedaling, the rate increase has stuck.

- The Dodd-Frank Act. Among other requirements, Dodd-Frank says that lenders should lend only to qualified buyers. Buyers who qualify for a mortgage, but who later decide they don’t want to pay off their mortgage can claim that they should not have been qualified and can sue their lender. Lenders have reacted logically by rejecting most mortgage applications.

- Slow Growth. If the housing market is recovering, it should be an indicator of overall economic growth. The economy grew at a pathetic rate of only 1.8% during the first quarter of 2013.

The U-6 unemployment rate is over 14%, with the only real job growth coming from part-time workers. Europe’s still a mess, China’s growth rate is slowing and no one knows what to expect in the Middle East.

Given current conditions, we’re not questioning why housing starts are down. But we do wonder why builder confidence is up.