“Demand is artificially high … and supply is artificially low.”

Fitch Ratings

We’ve written frequently about the disconnect between the real world and the stock and bond markets. Now the housing market has drifted into its own false reality.

While Gluskin Scheff’s David Rosenberg has referred to the stock market’s recent climb as a “Potemkin rally,” what’s happening in housing is Potemkin in reverse.

Russian minister Grigory Potemkin created a fake village to impress Empress Catherine II during her visit to Crimea, giving us the term “Potemkin” to mean an illusion, reality propped up to look bigger and better than it really is.

But while the Potemkin village gave us houses that weren’t there, today’s housing market has rallied based on buyers not seeing houses that are there. This shadow housing inventory is just one reason housing prices have jumped and its yet another example of the market distortions created by a combination of quantitative easing and stimulus spending.

Higher Housing Prices

Increasing housing prices are being perceived as good news and a sure sign that the economy is finally recovering.

The Standard & Poor’s/Case-Shiller index data released this week shows that housing prices in March were up 10.2% from a year earlier – the largest annual gain since 2006. The index even showed an increase of 1.2% for the first quarter for the first time since 2006; prices are typically stagnant during the slow winter season.

So why are housing prices rising? Has prosperity increased throughout the land? Not by a long shot.

It’s a matter of supply and demand. Low inventory is driving prices higher, as there are fewer homes for sale than there are potential buyers.

If housing prices were rising as a result of increasing demand, that would be good news, as it would signal that consumers are ready to spend again and, presumably, have the money to spend, since they otherwise would not qualify for a mortgage. Instead, a shortage of supply has been driving prices higher.

There are plenty of homes available, including many that are vacant because of foreclosure. They’re just not on the market right now.

As writer and blogger Wolf Richter put it, “vacant homes don’t evaporate. Private-equity funds have poured tens of billions into gobbling up vacant single-family homes in specific markets.”

For example, private equity firm Blackstone Group LP invested more than $3.5 billion purchased 20,000 vacant and foreclosed single-family homes, according to Bloomberg, and increased its credit line to $2.1 billion to buy more. Colony Capital LLC, which purchased 7,000 homes, is investing $2.2 billion more in home purchases.

Institutional investors have been investing to take advantage of the hot market for rentals, but the amount of rental property has increased to the point where supply is outpacing demand, so we can expect many of these homes to come on the market in the near future. And once the houses come on the market, if supply outstrips demand, housing prices will likely drop again or, at the least, stop rising.

It’s also worth noting that the increase in prices noted by the Case-Shiller index is not uniform. Prices are increasing most in markets like Phoenix and Las Vegas, where the private equity firms are making most of their purchases.

The potential increase in homes on the market is not the only factor that could shut down the housing recovery. If the economy truly is recovering, The Federal Reserve Board will be under increasing pressure to end its quantitative easing program.

As The Fed approaches $3 trillion in bonds in its portfolio, a growing number of people are recognizing that it can’t continue indefinitely. When QE does end, interest rates are bound to rise sharply. That will make homes less affordable, which will weaken demand, potentially leading to a drop in prices.

If, in spite of the evidence to the contrary, you believe the housing market is truly recovering, ask yourself why the price of lumber is plummeting.

Typically, the price of lumber is a leading indicator of what’s happening to the housing market. As the chart shows, building permits issued typically correspond closely to the price of lumber.

Even with QE and stimulus spending in place, housing has become increasingly unaffordable, as wages have slumped even as housing prices have been increasing.

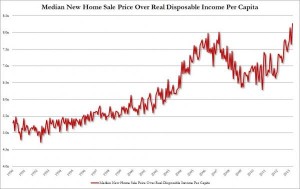

Median new home prices hit an all time high last week. To show how unaffordable housing has become, Zerohedge divided median home prices by the average American’s real disposable income and created the chart to the right, which shows that homes are now more unaffordable than they have ever been.

The federal government has done everything it can in recent years to make housing more affordable for Americans who can’t afford their own homes. Ironically, as a result of the latest government programs, housing is becoming so expensive, fewer and fewer Americans can afford to own a home.

With a lack of qualified buyers, and the potential for increasing supply and rising interest rates, another housing bubble may be on the horizon.