In a recent post, we speculated about what would happen when quantitative easing finally ends. This week we got a glimpse.

After Federal Reserve Chairman Ben S. Bernanke said that The Fed may cut the pace of its bond purchases, first U.S. Treasuries slid, then Japan’s bond market fell. When Japanese markets opened, the bond futures market was halted on a circuit breaker as the bond market took a swan dive. U.S. 10-year rates climbed to 2.07 percent, their highest level since March, while 10-year yields for Japanese bonds pushed up to 1% for the first time in a year.

Next came an announcement of a manufacturing slowdown in China, with the flash HSBC Purchasing Managers’ Index (PMI) falling from 50.4 points in April to 49.6 for May. Anything less than 50 points is a contraction.

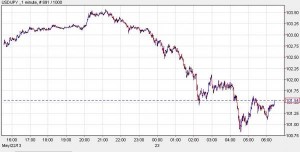

“And then,” as Zerohedge put it, “all hell broke loose, with the Nikkei first rising solidly and then something snapping loud and clear, and sending the index crashing a massive 1,143 an intraday swing of 9% high to low, leading to an over 200 pips move lower in the USDJPY, and leading to a global risk off across the world.”

Thursday’s 7.3% drop in the Nikkei index was the sharpest plunge since the tsunami hit Japan in 2011. In comparison, Europe’s leading indexes closed down 2.1%, while in the U.S., the S&P 500 finished the day down just 0.3%, but the day was marked by high volatility.

A Big “If”

Keep in mind that the Fed Chair wasn’t announcing the end of quantitative easing. He said The Fed may cut the pace of its bond buying at its next few meetings if The Fed sees signs of sustained economic growth.

That’s a big “if.” The most recently reported unemployment rate was 7.5%, which is still a solid percentage point above The Fed’s target rate of 6.5%. Then again, we live in an age of diminishing expectations.

Given that The Fed has been buying $85 billion in bonds a month and that quantitative easing has been speeding along non-stop for five years, you’d think a halt to quantitative easing would be long overdue.

A Socialized Bond Market

As a result of its bond buying, The Fed now owns a record 30.5% of the U.S. bond market, including 30.32% of all outstanding 10-year equivalents, Zerohedge reported, adding that the amount of 10-year equivalents held by the Fed increased to $1.583 trillion from $1.576 trillion in the prior week, which reduces the amount available to the private sector to $3.637 trillion from $3.668 trillion in the prior week.

“America may or may not be becoming increasingly socialist and/or nationalized,” Zerohedge concluded, “but there is no doubt about it: its bond market most certainly is.”

But QE is continuing unabated. QE may not be creating jobs, as was the announced intention, but if it were to stop tomorrow, stock prices would likely plunge, government borrowing costs would rise, The Fed’s portfolio of bonds would decline in value and inflation would increase.

So QE will continue, the federal government will continue spending beyond its means, the dollar will stay weak, interest rates will stay low and unemployment will remain high.