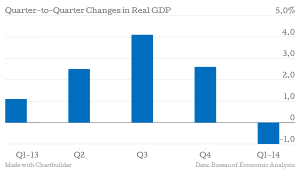

The recovery that wasn’t a recovery may have come to an end, as the Bureau of Economic Analysis reported that gross domestic product dropped by 1% during the first quarter of 2014.

Even with the drop in GDP, lower housing sales and continued high unemployment, no one is saying the economic is in a recession. Perhaps when a recovery is as insignificant as the one we’ve experienced for nearly five years, the distinction between recession and recovery is insignificant.

The economy was in sad shape five years ago and it’s in sad shape today, in spite of record stimulus spending, bond buying, and warm and fuzzy messages from the President, Congress and the Fed.

But fear not. The bar is so low now, even a baby step over it will look like a high jump. At least that’s the opinion of PNC Chief Economist Stuart Hoffman who wrote, “I believe this real GDP decline, mostly due to the polar vortex, coiled the ‘economic spring’ even tighter for a sharp snap-back (boing!) this quarter, where I have an above-consensus forecast for a 4.0% annualized rise in real GDP.”

But fear not. The bar is so low now, even a baby step over it will look like a high jump. At least that’s the opinion of PNC Chief Economist Stuart Hoffman who wrote, “I believe this real GDP decline, mostly due to the polar vortex, coiled the ‘economic spring’ even tighter for a sharp snap-back (boing!) this quarter, where I have an above-consensus forecast for a 4.0% annualized rise in real GDP.”

In other words, bad news for the first quarter is good news for the second quarter. Stop me if you’ve heard that story before.

Recall that economists and politicians were initially predicting 3% growth throughout 2014 (that’s below average historically, but an elusive goal for the post-financial crisis Obama era). Then the forecast for Q1 fell to 1.2% growth. Then 0.1% growth. And now reality shows that the economy shrunk by 1%. So excuse me for believing that a prediction of 4.0% growth for Q2 is just more irrational exuberance.

When growth of 0.1% was announced, we noted that causes included a drop in trade and low growth in inventories, which surged in Q4 of 2013. So how can the polar vortex be held responsible?

It’s more likely that the economic spring has snapped from being so tightly wound. And, as we’ve previously noted, the “recovery that wasn’t” has stretched to the length of a typical recovery and may be giving way to the “recession that will be.”

Bad News Is Still Good News

Absurd as it may seem, Hoffman apparently isn’t the only one who believes, as CNBC reported, that “today’s negative GDP number was excellent news.” Even with tapering in full swing, stocks surged ahead.

But a continuing rise in stock prices is about as likely as 4% GDP growth.

So what’s an investor to do? Lance Roberts of STA Wealth Management, for one, is bullish on bonds.

Predictions in late 2012 of a “great rotation,” with investors taking money out of bonds and investing it in stocks, never materialized and are less likely now, as stock prices are overvalued by virtually any measure and interest rates have recently been declining.

You read that right. Interest rates have been declining, even as the Federal Reserve Board continues tapering. Keep in mind that interest rates reflect a demand for credit; they will fall when demand is low and demand will be low when GDP is negative.

As Roberts notes, “While there is certainly not a tremendous amount of downside left for interest rates to fall in the current environment – there is also not a tremendous amount of room for them to rise until they begin to negatively impact consumption, housing and investment.”

He even suggests an anti-great rotation:

“Bonds are currently exhibiting some of the best valuations that we have seen in the last couple of years with the technical indicators stretched to extremes. Exactly the opposite is true with the stock market with valuations (based on trailing reported earnings – the only true measure of valuations) pushing levels normally associated with bull market peaks, prices at extreme extensions and earnings peaking. This is the time when investors should be thinking about taking some profits by ‘selling stocks high’ and adding some relative safety by ‘buying bonds low.’ After all – it is what we are supposed to be doing as long term investors.”

We wouldn’t recommend selling all of your stocks and investing the money in bonds, but it makes sense to include bonds as an important part of a diversified investment strategy.