The weather has done it again.

The U.S. Bureau of Labor Statistics last week reported annualized growth of a piddling 0.2% for the first quarter of 2015. The culprit, of course, is not bad policy, but bad weather, if you believe the Federal Reserve Board.

Last year the economy would have boomed during the first quarter, no doubt, if not for the “polar vortex,” but instead it shrunk by more than 2% (experts use the oxymoron “negative growth”). The same people who believe that will likely believe that the U.S. economy would have boomed during the first quarter of 2015 if not for the dreadful winter.

At least no one’s using the term “polar vortex” to describe the non-stop snowfall that hit much of America this past winter. And this year’s first quarter growth is multiples better than last year’s first quarter mini-recession.

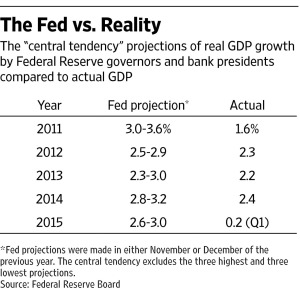

Winter may be over, but the economy remains cooled. The Fed is likely hoping for monsoons, tidal waves and earthquakes over the next few quarters to rationalize yet more non-growth in an economy that falls short of Fed projections. Per the chart below, the Fed has been overly optimistic about economic growth for each of the past four years – and that streak is likely to continue this year, given first quarter performance.

Fed predictions for the future continue to be rose-colored, but not as rosy as they were previously, based on the Fed policy statement issued last week.

“Federal Reserve policy makers said some of the headwinds holding back the U.S. will probably fade and give way to ‘moderate’ growth,” Bloomberg reported. Maybe the Fed considers 0.3% annualized growth to be “moderate,” since it would be a 50% improvement over the first quarter.

Other factors cited as affecting economic growth include:

- The strengthening dollar, which has been boosted by the end of quantitative easing here and the beginning of QE in other countries.

- Lower oil prices, which resulted in a slowdown in the energy sector – the one sector of the economy that has been thriving in recent years.

- Dock worker strikes on the West Coast, which disrupted exports. Maybe the economy slowed down to demonstrate solidarity with the dock workers.

Transitory Factors

In its policy statement, the Fed said the slowdown was due, “in part” to “transitory factors.” So the economy has stumbled along, not even hitting 3% growth for nine years and we’re supposed to attribute the current economic state to transitory factors. When something is “transitory,” it is expected to change after a brief period. Our economic doldrums have been anything but “transitory.”

As The Wall Street Journal put it, “Transitory or not, growth sure was lousy.”

The Fed may have been referring to oil prices, which dropped to the point where the booming oil shale industry stopped booming. But even if oil prices return to higher levels, the industry can’t just flip a switch and resume drilling. And, ironically, falling oil prices were the one bright spot for American consumers, giving them more disposable income and causing consumer spending to increase (although apparently not enough to boost economic growth).

It should be clear to anyone who is not a member of the Federal Open Market Committee that Fed policy is not working. The Fed’s twin mandate has been to maximize employment and stabilize prices, which for some reason it interprets as boosting the rate of inflation to 2%.

After trillions in bond buying and years of ZIRP (zero interest rate policy), it has accomplished neither. Inflation in the U.S. has been minimal and is likely to stay that way, given that the dollar has strengthened considerably, making imports cheaper. Maybe the Fed should declare victory and move on, since cheaper prices, combined with increasing income (finally) should boost consumer spending.

And while the unemployment rate has dropped considerably, the drop is largely due to millions of Americans having given up looking for work.

“One reason the jobless rate has fallen to 5.5% is because so many people have left the workforce,” according to The Wall Street Journal. “The labor participation rate has plunged to 1978 levels during this supposedly splendid expansion. Most economists acknowledge that if the participation rate had stayed constant, the jobless rate would still be close to 8%.”

When headwinds prevail, those who are steering the boat have two choices. They can continue to move full force into the headwinds and get nowhere – or they can change direction. Changing direction would be the wiser choice today.