There has been much market panic of late over the possibility that the Federal Reserve Board will be raising interest rates sometime in the not-too-distant future.

Small cap stocks were the first casualty. As September ended, the S&P 500 was still up 7.3% for the year, while the Russell 2000 was down 3.8% and off 7.4% from its high in July. Even after being up more than 40% year-over-year at the end of December, the Russell 2000 was negative year-over-year on Wednesday before having its best day in six weeks on Thursday.

As The Wall Street Journal explained, “Given that periods of market turmoil tend to buffet small stocks more than their larger counterparts, many investors in small companies are fearful as the Federal Reserve moves toward raising interest rates. Even investors hopeful for small stocks are proceeding with caution.”

But should the markets be this skittish over interest rates?

In September, Fed Chair Janet Yellen announced that interest rates will remain low for “a considerable time” even after quantitative easing (QE), the Fed’s bond-buying program, ends. QE is scheduled to end this month, but could be extended.

Economic data continues to be mixed. The official U-3 unemployment rate dropped to 5.9%, but the percentage of Americans participating in the workforce is at a 36 year low. Jobs are increasing, but four out of five of them are for low or minimum wages. So QE could be extended, since its alleged purpose is to help the economy grow.

Even if QE ends this month, the “considerable time” Ms. Yellen cites could, indeed, be considerable, given the consequences of raising interest rates.

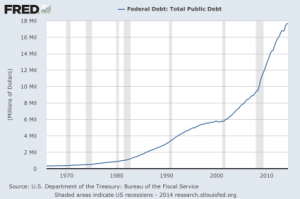

Impact of Rising Rates on Federal Debt

As rates rise, it’s unlikely that the Fed will be able to continue to push the stock market to new records. But higher rates will have additional consequences, including a huge impact on U.S. debt.

Federal debt, as of this week, reached $17,781,487,901,300.17.

Consider that the average rate of interest on the government’s marketable debt in August was just 2.028%, while in January 2000 it was 6.620%. If interest rates rise back to the level they were at in 200, the U.S. will need to pay more than a trillion dollars a year just in interest payments.

That’s money that does not pay for educating our kids, supporting our healthcare system, fixing our infrastructure or keeping the country secure. It buys nothing. It only keeps our federal government operating – and continuing to rack up more debt.

You may have heard that President Obama and the U.S. Congress have the federal deficit under control. Remember the budget cuts that took place because of sequestration? According to the U.S. Treasury, the federal government officially ran a deficit of $589 billion for the first 11 months of fiscal year 2014. That’s an improvement from previous years, in which the deficit exceeded $1 trillion.

But according to U.S. Treasury numbers, on Sept. 30, 2013 the U.S. national debt was $16,738,183,526,697.32. So how come it’s now more than $1 trillion higher?

As Michael Snyder notes in his “Economic Collapse” blog, the $589 billion number “is just for public consumption and it relies on accounting tricks which massively understate how much debt is actually being accumulated.”

Already, the United States has more government debt per capita than Greece, Portugal, Italy, Ireland or Spain. It’s not always good to be number one.

Federal debt does not receive the media attention of issues such as climate change, which may or may not have a negative impact on future generations. But it is a certainty that your children and their children will see their quality of life erode significantly unless something is done to control the federal debt.

If you love your children, you may want to ask your Congressional representatives to do something about the federal debt.