What was I thinking?

Over the past couple of years, I’ve preached caution. Corporate profits were down and unemployment was up. The economy wasn’t growing, but the federal debt was. Iran was developing nuclear capabilities while the entire continent of Europe was going bankrupt. And investors were still shell shocked from the 2008 financial meltdown.

Not a good time to invest in stocks. Not a good time to invest, period. Common sense dictated restraint.

And the federal government’s answer was to spend as much as possible, while printing more money and buying more bonds than at any time in history. After record stimulus spending and $4 trillion in bond buying, common sense would suggest high inflation and a sagging stock market; a good time to invest in gold and other hard assets.

But common sense has become uncommon and senseless. Only a fool would invest in a stock market pumped up on Fed steroids, but it’s a fools’ world today and the fools are rolling in money. The S&P 500 is up nearly 40% since early 2012 and has almost tripled since its 2009 lows.

Meanwhile, prudent investors have earned little, rationalizing that risk is too high. So who are the fools now?

Bungee Jumping With Your Savings

Investing in stocks over the past five years has been like bungee jumping with your life’s savings, hang gliding on a windy day. And yet the bungee cord held and the wind died down. Ben Bernanke has been the investor’s guardian angel.

Maybe it’s more accurate to compare investing in stocks today with running a red light. It’s dangerous. It can cause great damage. But sometimes you get away with it and finish ahead of the cautious driver.

We’ve heard over and over that the economy is turning the corner, that housing prices are recovering, that jobs are being created, that America is going back to work and is making money again.

Yet results have been consistently disappointing – except for the stock market.

So what’s the prudent investor to do?

What’s worked has been the opposite of what logic would dictate. So maybe, as of now, I will no longer stop at red lights. Red means go. Forget three square meals a day – all my meals will now be round. I will sleep all day and work all night. I will punish my kids for doing their homework.

Except that’s not me. And it shouldn’t be you. Now would be a bad time to abandon prudence. So I will continue to be a fool. And do you know why? Because any day now, the fools will be right.

It’s not a buy high and sell low world. Look at the market for the past week and see for yourself. Equities closed down for the fifth day in a row for the first time since mid-September, while the number of new 52-week lows reached was at its highest in almost four months.

Lance Roberts of STA Wealth Management wrote on Zerohedge that, “Bubbles are created when investors do not recognize when rising asset prices get detached from underlying fundamentals.” That certainly sounds like today’s market.

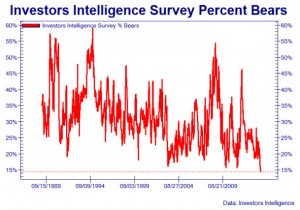

Another sign of a bubble is that even the most cautious investors are taking their foot off the brake. Investor sentiment has not been this bullish for 30 years, according to Adam Taggart of Peak Prosperity. It’s even more bullish than it was in the late 1990s.

As John Hussman put it, “The problem with bubbles is that they force one to decide whether to look like an idiot before the peak, or an idiot after the peak.”

Decide for yourself, but be sure to ask yourself if you really want to invest in stocks when the companies’ fundamentals don’t support your investment.