President Obama’s campaign slogan for last year’s election was “Forward.” The Federal Reserve Board’s slogan in the coming months may be “forward guidance.”

According to Goldman Sachs, The Fed is expected to begin tapering its bond buying in September, but will place more of an emphasis on “forward guidance.”

So what exactly is “forward guidance?” Here’s how The Fed defines it:

“Through ‘forward guidance,’ the Federal Open Market Committee provides an indication to households, businesses, and investors about the stance of monetary policy expected to prevail in the future. By providing information about how long the Committee expects to keep the target for the federal funds rate exceptionally low, the forward guidance language can put downward pressure on longer-term interest rates and thereby lower the cost of credit for households and businesses, and also help improve broader financial conditions.”

In other words, it’s pontificating and predicting.

To Guide Forwardly

We’ve suggested in the past that The Fed could save the country a great deal of money and economic angst if it just talked about monetary policy, rather than doing anything, since the market reacts to what is said more than to what is done. Apparently, The Fed has come around to our way of thinking. Who says actions speak louder than words?

Of course, Goldman Sachs may just be providing its own forward guidance, but if any private institution knows what to expect from The Fed, it’s likely to be Goldman Sachs.

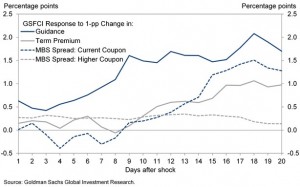

Goldman’s own research, which modeled the impact of forward guidance and bond purchases on mortgage rates and financial conditions, found that “forward guidance has larger and more persistent effects on financial conditions than Treasury purchases.”

Goldman Sachs also found that purchases of mortgage-backed securities (MBS), which began with QE3, have a greater impact than Treasury purchases, a finding that’s consistent with a study presented to the Federal Open Market Committee during a recent Jackson Hole symposium. Goldman Sachs research, and the study presented at Jackson Hole, also found that the purchase of newly issued (current coupon) MBS more effectively lower mortgage rates than the purchase of higher-coupon MBS.

In light of its findings, Goldman Sachs predicted that tapering will initially focus on reducing purchases of Treasury bonds.

A separate paper presented at Jackson Hole, interestingly, noted that The Fed’s recent attempt at forward guidance backfired. When Fed Chairman Benjamin Bernanke announced in May that it might soon begin scaling back its bond purchases, markets became volatile.

“Once that view was conveyed to markets,” The Wall Street Journal noted, “it drove a big shift in market positions, to a degree that was very surprising to many observers.”