Measuring growth in Gross Domestic Product (GDP) is like taking the economy’s temperature.

The annualized growth rate of 1.5% at the end of the second quarter – which is a sliver above the projected 1.4% rate – indicates that the patient is still alive, but barely.

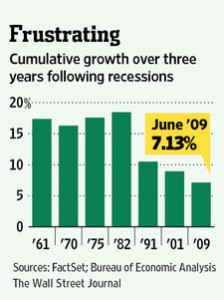

The economy is not quite on life support, but compare that growth rate with cumulative growth in the three years following previous recessions. For the four recessions in the ‘60s, ‘70s and ‘80s, the cumulative growth fell between 15% and 20%. For the most recent recession, the cumulative growth rate for three years is just 7.13%, according to The Wall Street Journal.

As the chart shows, post-recession growth was lower than the +16% cumulative rate of other modern-day recessions, and even well below the 9% growth rate of 2001. That’s in spite of extensive government efforts, including the $814 billion economic stimulus program, two rounds of quantitative easing, Operation Twist and other efforts … or could these government programs have possibly slowed economic growth?

“In addition to years of negative real interest rates courtesy of the Fed, federal borrowing has grown at about three times the rate typical for postwar recoveries,” according to The Wall Street Journal. “In other words, Washington already has unleashed far more firepower on the downturn than usual and received scant bang for its buck.”

In addition, 2010 GDP was revised from 3.0% to 2.4%, while Q3 2011 GDP was revised from 3.0% to 4.1%, according to Zerohedge.com, “indicating that the slowdown we are experiencing is in fact far worse than previously expected.”

Typically, the farther the economy falls, the greater the recovery in GDP growth, so the current recovery should have been stronger than other recent recoveries.

Under the Rule of Monetary Policy

Given overall economic conditions, it’s no surprise that profits are softening, too. Facebook’s first quarterly report, for example, was underwhelming and did not cheer holders of its stock.

But some are cheered by this news, because they believe it will force the Federal Reserve Board to take action yet again and give us another round of quantitative easing (QE3).

It’s not a good sign when the market is moved by monetary policy, but by market fundamentals.