With all of the talk in Washington about equality, you have to wonder how the gap between rich and poor has widened to the point where even The New York Times is questioning the future survival of the middle class.

Some have, indeed, made the transition from middle class to upper class and are enjoying a more comfortable lifestyle. They may not be part of the 1%, but they’ve broken away from the middle.

The New York Times noted that, “In 2012, the top 5 percent of earners were responsible for 38 percent of domestic consumption, up from 28 percent in 1995 … Even more striking, the current recovery has been driven almost entirely by the upper crust … Since 2009, the year the recession ended, inflation-adjusted spending by this top echelon has risen 17 percent, compared with just 1 percent among the bottom 95 percent.”

Put aside your class envy for a minute, though, and recognize that consumer spending by the top 5 percent is keeping the economy out of a recession – albeit, the current recovery has been so weak we may as well be in a recession.

The Great Divide

And while some are moving up, many more are falling down, creating a greater divide than ever between rich and poor. Consider a few statistics from a cheery blog called, The Economic Collapse (and republished on Zerohedge):

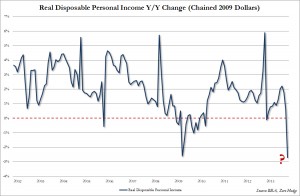

- Real disposable income just experienced it’s largest drop since 1974, falling 0.2% in a month and 2.7% from a year ago. Maybe we haven’t had enough quantitative easing and government spending?

- Middle-wage jobs accounted for 60% of jobs lost during the last recession, but only 22% of jobs created since then.

- Median household income has fallen annually for the past five years, from $55,627 in 2007 to $51,017 today, based on Census Bureau statistics. That’s a drop of 8.3%.

- U.S. consumer debt totals $11,360,000,000,000. The average credit card debt for Americans is $15,279, the average student loan debt is $32,250 and the average mortgage debt is $149,925.

- Consumer credit has increased 22% in just three years. More than half of Americans have subprime credit, meaning that they will now qualify for traditional bank loans and will have to pay a high rate of interest if they have to borrow money. And they probably will have to borrow money, as nearly half of Americans are living “paycheck to paycheck.”

- During the Obama administration, the number of Americans on food stamps has increased from 32 million to 47 million, the percentage of working age Americans that is working has dropped from 60.6% to 58.6% and the average duration of unemployment has increased from 19.8 weeks to 37.1 weeks.

- While there has been much talk about a housing recovery, the rate of homeownership has fallen for eight consecutive years.

- A record 49.2% of Americans receive monthly benefits from at least one government program. That means half of Americans are supporting now only their own family, but someone else’s family.

The Role of Government

So does government need to do more? Is government spending ineffective? Or is government a cause of the problem?

You decide, but as we previously noted, we’ve spent $20.7 trillion since the War on Poverty began 50 years ago and the percentage of Americans living in poverty today is that same as it was when the war began – about 15%.

And just as consumer debt has increased, so has government debt, which has grown by $6.666 trillion since President Obama took office and now exceeds $17 trillion. According to the Congressional Budget Office, interest payments on the national debt will nearly quadruple over the next 10 years.

At the same time, as we’re previously reported, unfunded liabilities for Social Security, Medicare and federal employee pensions are approaching $100 trillion.

Baby boomers have begun retiring and are beginning to take money out of the Social Security system, which is a pay-as-you-go system. The number of workers supporting each retiree will decrease from 4.5 today to 3 by 2030.

Who is going to pay all of that debt? You could take every dollar from the top 5% and it wouldn’t nearly be enough. Those who are poor are the recipients of government services and don’t pay taxes.

That leaves the middle class.