Part two of a two-part series.

Before spending trillions of dollars on climate change, someone should ask whether it should be society’s top priority.

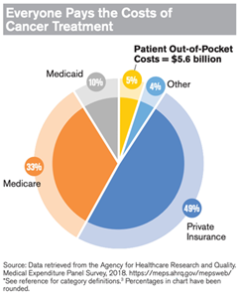

What’s more important? Trying to keep the temperature from rising by a few degrees or curing cancer? Which would provide a greater return on investment? Investing in a cure for cancer, which killed 599,601 Americans in 2019, or reducing carbon dioxide emissions, which may cause the temperature to rise by 2.5 degrees over the next 30 years?

Consider the difference in how Congress and the president treat drug companies compared with how they treat “green” companies. Look at Tesla vs. Moderna, which created a vaccine that is more than 95% effective against COVID-19.

Tesla. With a net worth approaching $300 billion, Tesla CEO Elon Musk is now the world’s richest man. Tesla, his electric car company, is valued at more than $1 trillion. In contrast, General Motors is valued at $79 billion.

Musk is a brilliant entrepreneur, who has amassed his wealth through startups that include PayPal, Space X and SolarCity, but Tesla is his big winner.

Tesla sold nearly a half million cars worldwide in 2020. In contrast, GM sold 6.8 million cars in 2020 (including more than 200,000 electric vehicles). GM outsold Tesla by a factor of 1,360%, yet Tesla’s valuation exceeds GM’s by 714%.

So why is Tesla worth so much more than GM? Musk’s oversized personality is one reason, but another reason is government subsidies. In 2015 alone, Musk companies benefited from $4.9 billion in government subsidies.

In the first nine months of 2020, “Tesla reported net income of $451 million, which has impressed Wall Street – but that should be taken with a huge grain of salt,” according to The Motley Fool. “Competing automakers paid Tesla $1.18 billion over that period for automotive regulatory credits, without which the company would have lost money.”

Other electric car companies are getting in on the action, too. Rivian, for example, went public in November and is valued at $120.5 billion even though it has sold only 156 cars – mostly to its employees.

“Rivian’s valuation seems less a reflection of investors’ confidence in the company than in government policies to encourage and eventually force consumers to buy EVs,” according to The Wall Street Journal. “Even Rivian in its prospectus noted that ‘regulatory requirements and incentives’ as well as future bans on the sales of internal combustion engines are a business ‘tailwind’.”

GM has had its share of government handouts, but Tesla and other EV companies represent the future – whether electric cars are good for the environment or not. Electric cars – like wind and solar power – are accepted as the best alternatives for our environment. And they’ve been picked as a winner by the federal government.

Even without Build Back Better, there’s a long-standing $7,500 federal tax credit for anyone who buys an electric vehicle (EV). Some states provide additional incentives. California, for example, also provides a $2,000 to $4,500 rebate or a $5,000 grant, based on income, for anyone who buys an EV. Build Back Better also includes a 30% business tax credit for commercial EVs.

Moderna. Meanwhile, Moderna is in a dispute with the National Institutes of Health (NIH) over patents for its COVID-19 vaccine.

Some argue that “NIH deserves credit for Moderna’s gene sequence and should be named on the principal patent application because government researchers picked the coronavirus spike protein as the vaccine target,” according to The Wall Street Journal. “But virtually all Covid vaccines target the spike protein, including those made by the Chinese. Moderna’s significant contribution was choosing the particular gene sequence to reverse engineer the spike.”

The federal government invested $2.5 billion toward the development of Moderna’s vaccine, but it’s based on patents that existed before the pandemic. Moderna has offered to license the government’s patent on the same payment terms as other manufacturers.

Moderna has also been pressured to share its patents with other countries, including China, without taking a profit. It has agreed not to enforce its patents until the pandemic ends.

In addition, the Build Back Better plan includes drug price controls. Price controls result in drug shortages, lower research and development spending by pharmaceutical companies, fewer drugs reaching the market, and longer wait times for drugs that do.

What if the treatment of these industries were reversed? We could make solar and wind power affordable overnight by mandating their prices. There’d be an electric car in every garage and, with trillions of dollars in assistance from the federal government, we may even be able to cure cancer.