Part two of a two-part series.

When the economy is fully recovered, the Fed’s zero interest rate policy (ZIRP) will need to continue to support the Biden Administration’s record spending. Even with interest rates near zero, the federal government is paying nearly half a trillion dollars a year just to service the federal debt. If interest rates and spending continue to increase, the cost of servicing the debt will multiply.

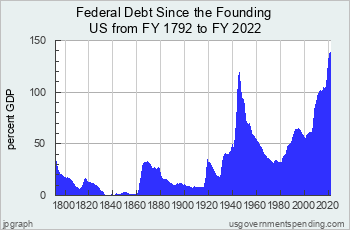

People who pay the minimum on their credit cards eventually go broke. Yet that’s what the federal government is doing, even as it plans more spending. The federal government now has unfunded liabilities approaching $150 trillion, along with debt exceeding $28 trillion.

Perhaps the pandemic offers too good an excuse for excessive spending to let the opportunity go to waste. The American Rescue Plan, approved in January, began the year with $1.9 trillion in spending, including stimulus checks and excessive unemployment benefits that pay many Americans more money for not working than if they had been employed.

With people being paid more to stay home, a moratorium on eviction of tenants who don’t pay rent, and increased benefits from the Affordable Care Act, it’s no wonder that an increasing number of working class Americans have joined the non-working class.

“If you give people things they typically get from a job, don’t be surprised when they don’t take a job,” Gramm and Scott wrote.

The unemployment rate fell to 6% in March, but bumped to 6.1% in April, even as the Labor Department reported record job openings. The National Federation of Independent Business found that a record number of small businesses are unable to fill job openings, because of a lack of applicants.

President Biden suggested a solution: Just pay your workers more. Small business owners, who were just struggling with pandemic lockdown and, in many cases, looting and rioting, are being told that they need to share a greater percentage of their profits, but certainly not their loses, with their employees. They can also expect higher taxes and more regulations, and perhaps a $15 minimum wage, which has been endorsed by the Biden Administration.

With higher inflation, these same small business owners are now paying more for their supplies as well. Some will be able to pass on their higher costs, by charging higher prices. Some will go out of business.

Meanwhile, the Biden Administration has proposed other multi-trillion dollar spending bills, including $2.3 trillion for the American Jobs Plan and $1.8 trillion for the American Families Plan.

Who can oppose American jobs and American families, you may wonder? The American Jobs Plan includes $621 billion to modernize transportation infrastructure, $300 billion to boost manufacturing, $213 billion to retrofit and build affordable housing, and $100 billion to expand broadband access. While the Biden Administration says it will create 19 million jobs, but, because it would be funded with higher corporate taxes, it may actually cost jobs.

The American Families Plan would extend the expanded child tax credit included in the American Rescue Plan, provide tuition-free community college and preschool care, and more.

Former Treasury Secretary Larry Summers, who served as an economic adviser to Presidents Obama and Clinton, called the Biden stimulus proposals “the least responsible macroeconomic policies we’ve had in the last 40 years.”

Likewise, Jason Furman, who chaired President Obama’s Council of Economic Advisers, recently said the American Rescue Plan is definitely “too big for the moment,” adding, “I don’t know of any economist that was recommending something the size of what was done.”

Low-Income Americans Hurt Most

The record spending and bond buying taking place is supported by progressives who say they want to help the poor, but ironically, the inflation resulting from such policies only makes the poor become poorer.

As The Washington Post noted, inflation disproportionally hurts the poor.

The cost of housing increased 19% in April from a year earlier, in part because of low interest rates. Energy costs were up 8% and the cost of fresh food rose 5% from a year ago.

Those who are poor will, of course, find it difficult to afford such cost increases. Multi-trillion dollar spending bills that cause more inflation won’t help.