“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” John Kenneth Galbraith

While we just completed a very good year for investors — and a very good decade — we all know that the good times will not continue forever.

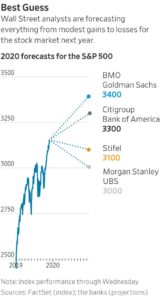

Will the record bull market end in 2020? Will it continue for years to come? Will the economy fall into a recession?

No one knows the answers to these questions and we’re not going to make any predictions. But it’s important to look at the facts and to prepare for the future based on expectations.

When the stock market faltered in 2018, it set the bar lower and created room for prices to rise in 2019, although they rose significantly higher than most people anticipated. It’s highly unlikely that stocks will repeat that performance in 2020.

An Earnings Recession

Valuations are currently higher than is warranted by profits. S&P 500 companies were in an earnings recession in the second quarter of 2019. An earnings recession takes place when earnings of S&P 500 companies decline for two consecutive quarters. The recession continued into the third quarter, but earnings were better than expected and that helped boost the market.

As fourth quarter earnings are reported, maybe companies can beat expectations again, but the earnings recession could worsen, which may have a negative impact on the stock market.

I say “may,” because profits and other fundamentals aren’t the only factors that affect the market. During 2019, actions by the Federal Reserve Board and geopolitical factors had a greater impact on stock prices than did corporate profits.

Just as stock prices fell at the end of 2018 when the Federal Reserve Board raised interest rates, they jumped in 2019 as a result of the Fed’s lowering of interest rates. The Fed lowered interest rates three times in 2019, dropping the federal funds rate to a range of just 1.75% to 2.00% (half of the historical average of about 3½%).

The market also fluctuated based on the on-and-off trade negotiations with China. When it appeared that an agreement was near, the market responded favorably. When there was a setback, stock prices fell.

How Low Can Rates Go?

If the economy shows weakness in 2020, the Fed is likely to drop rates again, which could boost the market. But the impact of a weaker economy may outweigh Fed actions.

If the record recovery ends and a recession begins in 2020, as some economists have predicted, the Fed has room to drop rates further, but not much. It could continue to drop rates and even adopt negative rates, but that has not worked well in other countries.

In fact, the United States economy has outperformed the rest of the world and countries with negative rates have experienced anemic performance.

A weaker economy could also lead to other actions, such as increased government spending or additional tax cuts.

Tax reform and deregulation spurred the economy and brought back 3% growth for the first time since before the Great Recession. But would the political will be there for another round of tax cuts? And would further cuts stimulate growth again? Or would Congress resort to the Keynesian approach of more government spending, which hasn’t been an effective economic stimulant in the past?

Trade Agreements May Help

Then again, the economy may perform just fine in 2020. Trade wars and tariffs shaved nearly 1% off of economic growth in 2019. With progress being made on phase one of an agreement with China, the near-certain passage of the U.S.-Mexico-Canada Agreement and the potential of a quickly negotiated trade deal with Great Britain, trade agreements could boost economic growth throughout the year.

Until now, progress in trade negotiations with China has regularly been followed by disappointing setbacks. Whether things will be different this time remains to be seen.

LEIs Are Unreliable

Regardless, even though the recovery has already stretched to more than a decade, it could continue through 2020.

There are as many opinions about a coming recession as there are economists. And we can’t depend too heavily on economic indicators to determine whether a recession is coming, because, as The Wall Street Journal noted, even the best indicators of recessions are unreliable.

The Conference Board uses an index of 11 Leading Economic Indicators (LEIs) to predict economic growth and, according the The Journal, the most reliable indicators include the shape of the yield curve, business and consumer confidence, durable-goods purchases and housing starts, and the health of the labor market.

“Unfortunately,” The Journal concluded, “the LEI is somewhat unreliable as a forecaster and (is) often misleading.”

And while we take continued consumer spending as a positive sign for the economy, The Journal reported that consumer spending has risen before nearly every past recession, falling only after the recession began.

An Election Year

The performance of the stock market and of the economy is not completely dependent on economic factors, trade agreements and Fed actions.

“I don’t think we are going to be heading into an economic recession with a resulting market crash or major correction anytime soon,” Neil Jesani of the Forbes Finance Council wrote. “However, there is one factor affecting the stock market that is unpredictable and, I believe, has a more significant impact on its performance than ever before.

“I am talking about politics, both the national and international variety.”

It’s an election year. Markets will react based not only on who is elected president, but on actions taken and words spoken before the election.

It will be an interesting and potentially volatile year.