In his inaugural address, President John F. Kennedy inspired Americans to pursue public service when he said, “Ask not what your country can do for you – ask what you can do for your country.”

Today, he wouldn’t recognize his Democratic party, as the main theme of its presidential candidates seems to be, “Ask not what you can do for your country – ask what your country can do for you.”

Free healthcare. Free education. A guaranteed income. Cancelation of student loan debt. These are just some of the handouts being offered by the current crop of presidential candidates.

The idea of getting something for nothing is intoxicating. Who doesn’t want something for free? But, of course, everything has a price and these campaign trail promises are especially expensive.

Medicare for All, the socialized healthcare system advocated by many candidates, has a projected price of $32.6 trillion over its first decade. The cost of a universal basic income (UBI) of $12,000 a year is estimated to be $3.8 trillion a year, which is 21% of U.S. gross domestic product (GDP) or 78% of tax revenue.

The price of implementing The Green New Deal, which would eliminate the use of fossil fuels, is incalculable, because much of the technology it would require doesn’t exist. The Green New Deal also promises plenty of free stuff, such as a guaranteed income, which you can receive even if you don’t want to work.

Tax the Rich

While all of these goodies would be given for free to “the people,” of course someone will have to pay for them. That, of course, means the people with all the money – the top 1% of earners.

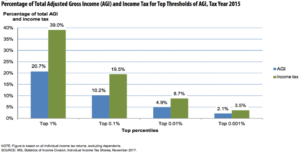

According to the National Taxpayers Union Foundation, “the top 1% of income earners bear the burden of 37% of all income taxes. This is nearly twice as much as their share of income (19.7%). The top 25% of earners shoulder nearly 86% of the income tax load. Combined, the top 50% of earners are responsible for 97% of income taxes collected. The other half of filers pay just 3% of all income taxes.”

In 2016, the top 1% of taxpayers accounted for more income taxes paid than the bottom 90% combined.

While there are plenty of tax loopholes and deductions, the wealthiest taxpayers pay more, because U.S. tax rates are the world’s most progressive. The Organization for Economic Cooperation and Development (OECD) found that, compared with the rest of the world, the U.S. “has the most progressive tax system and collects the largest share of taxes from the richest 10% of the population.”

In addition, the top 1% also account for about a third of all U.S. philanthropy, according to The Almanac of American Philanthropy.

Creating Equality?

The Democratic Robin Hoods who want to create equality should consider the following:

- The wealthiest taxpayers are already paying more than their fair share. In comparison, the bottom 50% of American taxpayers contribute only 3% of tax revenues collected by the federal government.

- The wealthiest taxpayers do not have enough money to pay for what’s being promised. Paying for even one of the “free” things being promised would require money from the middle-class taxpayers who are supposed to be benefiting from these programs.

- With at least a third of their revenues eliminated, non-profits in America would no longer be able to carry out their missions. America’s most needy would be hurt the most.

- Increase taxes on the wealthy and they will leave the U.S. or find loopholes, reducing the government’s overall tax revenues.

- Innovation will cease, because there will no longer be an incentive to innovate.

Even if everything being promised for free were affordable, it wouldn’t create equality. Consider the proposal from U.S. Senator Bernie Sanders to forgive $1.6 trillion of outstanding student loan debt.

“So who would pay?” The Wall Street Journal asked. “Americans who don’t have student debt — including the 98.5 million who didn’t go to college and the 106 million who did but either didn’t take out student loans or have paid them off.”

So if you’ve already paid for your kids’ college education, you can now pay for someone else’s college education in the name of equality.

And what lesson does this teach? Hard work and responsibility are punished in the new America. Work less and let someone else pick up the tab. JFK would not approve.