While the Federal Reserve Board may have contributed to December’s market swoon, it also played a role in the stock market’s best January performance in more than three decades.

In January, the Fed refrained from another increase and announced that it would be more “patient” in the future, signaling that the two rate increases expected in 2019 (initially three) may not take place.

With inflation in check, and even falling slightly below the Fed’s 2% target, and the economy showing signs of slowing down, there appeared to be little danger of the economy overheating and inflation increasing.

But Fed Chair Jerome Powell may have removed the wrong Jenga block.

When the Fed passed on another rate increase, Powell and the Fed were criticized by some for changing course and allegedly flip-flopping. Zero Hedge even ran a commentary calling the Fed decision, “An Obituary to Fed Credibility.” Others suggested that the Fed made a “U-Turn.”

While we have frequently been critical of the Fed, we can’t help but feel a bit of sympathy for Powell. If the Fed didn’t raise interest rates in December, he would have been called a patsy of President Trump. Instead, he now appears to be a flip-flopper.

In announcing the Fed’s decision, Powell cited cooling growth in Europe and Asia, as well as trade disputes, Brexit and the potential of another government shutdown.

Fed’s “Oops!”

Positive economic news is a good thing for American consumers, but it can cause some discomfort for Fed officials when it’s not expected.

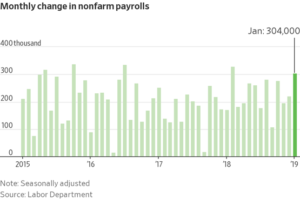

Just after the Fed’s announcement that it would be slowing its rate increases, the Labor Department announced that the economy added 304,000 new jobs in January. That’s a lot of jobs — and they were created in spite of the government shutdown. In previous months, the economy averaged 170,000 new jobs a month.

“Oops! An Awkward Moment for the Fed,” was The Wall Street Journal’s response.

So maybe the economy is stronger than the Fed thought — and the Fed may have to make another U-turn. Then again, there are plenty of signs that Powell is right about the economy. In spite of the jobs report, the housing market has cooled, the manufacturing sector has been uneven and consumer confidence has dipped.

In addition, inflation remains in check. The Phillips curve, which suggests that wage growth resulting from a tight labor market will drive inflation higher, has been inaccurate in the past and appears to be inaccurate yet again.

So perhaps it’s time for the Fed to ignore the Phillips curve and give up its obsession with 2% inflation.

Maybe the best approach for Powell is to follow Janet Yellen’s example and do nothing for a while. We’ll know that he’s bought into that approach if he issues one of her recurring policy statements after the next Fed meeting.